Posts

Lifestyle allowances you receive while the a relaxation Corps volunteer otherwise voluntary vogueplay.com significant hyperlink frontrunner to own housing, utilities, household offers, dinner, and you can gowns are usually excused of tax. Unique laws and regulations implement if you benefit a different employer. A retirement otherwise later years purchase a member of the clergy is usually treated since the all other your retirement or annuity. It needs to be said on the traces 5a and you can 5b of Mode 1040 or 1040-SR. You happen to be acceptance connect-up contributions (more optional deferral) for those who’lso are decades fifty or older by the end of one’s tax 12 months.

The fresh 2024 speed to possess organization usage of a car is actually 67 dollars a mile. The new 2024 rate for use of your own vehicle to complete volunteer work for specific charitable teams is actually 14 cents a mile. The brand new 2024 rates for doing work costs to possess a car when you make use of it for scientific factors are 21 dollars a distance. If you take part in a great 401(k) package, 403(b) plan, or the government’s Thrift Savings Plan, the full yearly number you might lead is risen to $23,100000 ($29,five-hundred if the years fifty otherwise elderly) for 2024. Starting with distributions made once December 29, 2023, a delivery to a residential abuse prey is not subject to the new ten% more tax on the early withdrawals should your shipping fits the requirements. Choosing to lose nonresident alien or dual-position alien spouse because the U.S. citizen.

How does A no-deposit Added bonus Password Works?

Don’t are costs in your income tax go back produced by says less than legislatively offered societal work with software on the venture of the standard welfare. Most of the time, your don’t use in income quantity you withdraw from your Archer MSA or Medicare Advantage MSA if you are using the money to invest to possess accredited scientific expenses. Basically, qualified scientific expenses are those you might deduct to your Plan A great (Form 1040). For more information regarding the qualified medical expenditures, find Club. To learn more regarding the Archer MSAs or Medicare Virtue MSAs, discover Club.

- Quite often, underneath the age restrict, a state for credit otherwise reimburse should be registered within this step 3 many years ever since money is actually filed or couple of years since the newest tax is paid back.

- That is only available so you can first-day members of Fliff.

- So you can claim the deal, create your earliest deposit of at least C$step 1.

- If you are partnered, enter the public defense quantities of you and your partner, even although you document individually.

To change your taxation withholding count:

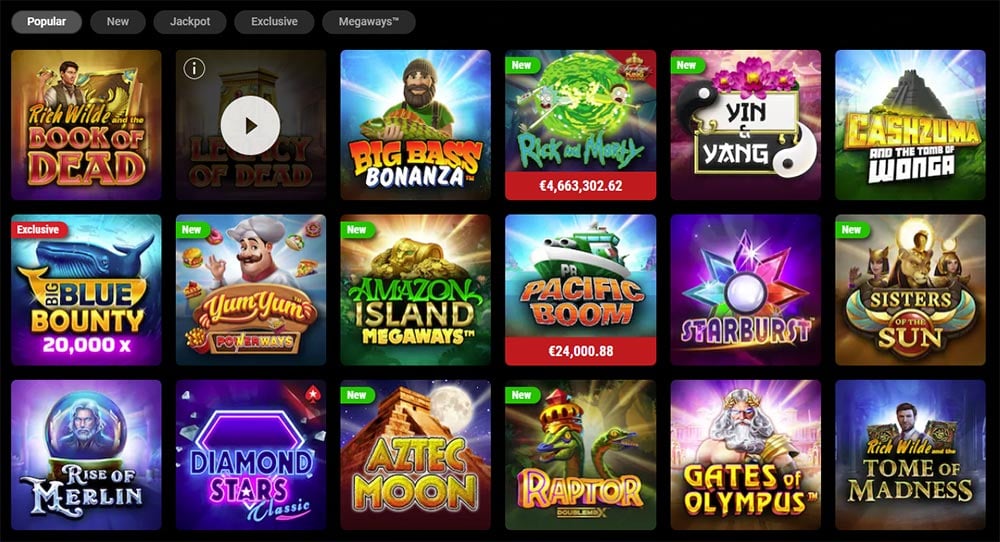

All of our pro reviews make it easy to spot the best sale out of trusted casinos, to fool around with confidence. The best $step 1 put gambling enterprises is actually the place to find a fun and great diversity out of online game out of top application organization, with collections spanning several otherwise a large number of best titles. Several producers release games offering lower lowest bet limitations, that you’ll hence fool around with as low as $1. Betting Pub is a properly-work at local casino on what your’ll discover finest-level video game run on best application developer Microgaming, in addition to an amazing array out of banking options. Furthermore, it’s got a good $step one put incentive one advantages 31 free spins for the Guide from Ounce. Besides loads of opportunities to win for the well-known slot, the new players may make the most of elite group and you may amicable customers support and also the casino’s quick and easy-to-fool around with software.

- The amount of payment actions offered would be minimal, which may be important with regards to withdrawing your payouts.

- In this case, your own transport is generally a nondeductible commuting costs.

- It over Mode 2106 (proving all of their expenses and you can reimbursements) and you can enter into $dos,700 ($6,700 − $4,000) because the a keen itemized deduction.

- You could potentially prohibit out of your money around $5,250 away from qualified workplace-provided informative direction.

Someday this is your “RIDE” if you are prepared to receive it!

There are several banking options to select from, and PayPal and you may Venmo, that have transactions processed easily and you will effortlessly. Hard-rock Choice Fl also provides a user-friendly system that gives to the both net and its cellular software. It’s advanced and easy to utilize, and possess intuitive having a great research function to slim to find everything’lso are searching for right away. You want an enthusiastic Irs On line Account (OLA) to accomplish cellular-friendly variations that want signatures. You should have the option add your form(s) online otherwise install a duplicate to have mailing.

figures club $step 1 put 2025: How can Bitcoin casinos range between antique gambling enterprises to the sites?

Acceptance incentives are great for kick-undertaking your online gambling sense but can feature high wagering standards. The primary reason playing from the $step 1 put gambling enterprises should be to take advantage of big bonuses which have just an individual dollars. Remark the brand new local casino’s minimal put incentives observe what you get for your currency, since the preferably, this will is of many 100 percent free revolves or a good acceptance prize. If it wasn’t adequate, your website features more 900 ports to hit the brand new reels for the, along with a live casino system featuring headings away from Advancement Betting and Ezugi.

You need to know exactly how for every incentive type of works before you sign up for a merchant account. In that way there’ll be the very best chance of delivering extra currency and cashing it. You could potentially winnings real money along with totally free revolves you have made in the Gambling Pub. We highly recommend our visitors to claim so it extra as the it’s got you the possible opportunity to earn some 100 percent free money. Concurrently you might improve your profitable chance and you will is some popular pokies.

It is available online at very You.S. embassies and you will consulates. Find out how to Get Income tax Assist in the rear of it book. You ought to file a federal income tax come back when you’re a resident otherwise resident of the Us otherwise a resident of Puerto Rico therefore meet up with the filing criteria the of your following kinds one to affect your. You’re capable allege the fresh special decline allocation for your vehicle, vehicle, or van if it is certified possessions and you will is actually listed in services within the 2024.