The specific identification method permits a company to pick specific clients that it expects to not pay. In this case, our jewelry retailer would use its judgment to assess which accounts might go uncollected. At the end of March, ABC reviews the allowance for doubtful accounts and determines that the estimate of uncollectible accounts was too low.

- The allowance for uncollectible accounts is an estimated amount of receivables a business doesn’t count on to gather.

- As A Outcome Of you can’t know prematurely the amount of unhealthy debt you may incur, learn to make an allowance for potential debts.

- This conclusion is bolstered by Dell’s beginning-allowance-to-write-offs ratio and its exhaustion price, each of which indicate Dell tends to exhaust its allowance in a little over one 12 months.

- In the intricate dance of financial reporting, the allowance for uncertain accounts performs a pivotal position, acting as a cushion against the inevitable bumps and bruises of credit sales.

The earlier allowance technique directly estimated the bad debt expense primarily based on the credit score gross sales recorded on the revenue statement of the enterprise. The percentage of credit score gross sales methodology directly estimates the unhealthy debt expense and data this as an expense in the revenue statement. For example, say a company lists a hundred clients who purchase on credit, and the entire amount owed is $1,000,000. The function of the allowance for doubtful accounts is to estimate what quantity of customers out of the one hundred will not pay the total quantity they owe.

Importance Of Accurate Estimation Of Uncollectible Accounts Underneath Gaap

On average, Apple had a beginning-of-the-year allowance for uncertain accounts that was nearly seven times greater than annual write-offs from 2000 to 2008. The inconsistency in the relationship between Apple’s allowance steadiness and write-offs is evidenced by the high, relative to the imply, normal deviation of that ratio over the interval. On average, Apple’s dangerous debt expense (see Exhibit 3) has been considerably lower than its write-offs for the previous 9 years.

What Is Accounts Receivable Assortment Period? (definition, Formula, And Example)

The bad debt expense account is used to report the estimated uncollectible accounts for the period. The allowance methodology of recognizing uncollectible accounts expense follows the matching principle of accounting i.e., it recognizes uncollectible accounts expense in the interval during which the related gross sales are made. Under this methodology, the uncollectible accounts expense is recognized on the premise of estimates. The first one is called getting older technique or steadiness sheet method and the second is named gross sales method or income assertion method. This reserve helps businesses anticipate potential losses from clients who’re unable or unwilling to pay, providing a more accurate illustration of internet realizable receivables.

The following entry should be accomplished in accordance along with your income and reporting cycles (recording the expense in the same reporting period as the revenue is earned), but at a minimal, yearly. The allowance methodology is a way for estimating and recording of uncollectible amounts when a buyer fails to pay, and is the preferred various to the direct write-off methodology. By recording cumulative dangerous debt expense that fell wanting write-offs over the past 9 years, Apple has taken steps to regulate its allowance downward over time. Apple’s annual write-offs proceed, even in 2007 and 2008, to fall far wanting its beginning allowance. Nonetheless, the beginning-allowance-to-write-offs ratio and exhaustion charges point out that Apple’s allowance for doubtful accounts was exceedingly excessive prior to 2000.

In apply, adjusting can occur semiannually, quarterly, and even monthly—depending on the size and complexity of the group’s receivables. Double Entry Bookkeeping is here to give you free online info to assist you learn and understand bookkeeping and introductory accounting. Upgrading to a paid membership offers you entry to our in depth assortment of plug-and-play Templates designed to energy your performance—as nicely as CFI’s full course catalog and accredited Certification Applications.

Estimating dangerous debt is crucial for maintaining correct monetary records and ensuring the business remains financially steady. There are a quantity of methods that businesses can make use of to estimate bad debt, each with its own advantages and limitations. In this part, we’ll explore some widespread strategies of estimating bad debt and delve into their intricacies. By decreasing https://www.personal-accounting.org/ the worth of accounts receivable, it additionally decreases the web revenue and total property of the business. This reduction in web revenue displays the potential losses from uncollectible accounts, offering a extra realistic picture of the corporate’s monetary health. This entry decreases net revenue by $2,000 and creates a contra asset account for the allowance for doubtful accounts, which is used to minimize back the accounts receivable balance.

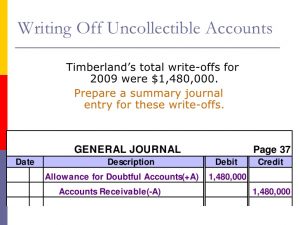

When an account is set to be uncollectible, the journal entry to write down off the uncollectible account includes debiting the allowance for doubtful accounts account and crediting the accounts receivable account. The quantity credited to the dangerous debt expense account is the estimated quantity of uncollectible accounts for the period. While the Direct Write-Off Method may be utilized in sure situations for simplicity or tax functions, it’s typically not preferred underneath GAAP. Adhering to GAAP in estimating uncollectible accounts is prime to reaching accurate, dependable, and transparent monetary reporting. By following GAAP pointers, firms can guarantee compliance, improve comparability, and preserve the trust of their stakeholders.

This proactive strategy can help in risk mitigation and better preparedness for financial downturns. This entry reduces the accounts receivable steadiness by $1,000 and reduces the allowance for uncertain accounts balance by $1,000. By making this journal entry, companies can ensure that the allowance for doubtful accounts is properly recorded and maintained.

How Bi And Analytics Enhance Management Accountants’ Partnering Function

By inspecting these real-world examples and case studies, firms across varied industries can acquire useful insights into efficient methods for managing uncollectible accounts. The Share allowance for uncollectible accounts of Sales Technique is a straightforward approach for estimating uncollectible accounts. This methodology depends on historical data to determine a consistent proportion of credit score gross sales which might be expected to become uncollectible. The major advantage of this method is its simplicity and ease of implementation, making it particularly helpful for corporations with regular gross sales patterns and predictable dangerous debt rates. The Share of Gross Sales Methodology estimates dangerous debt expense as a share of whole credit sales for a given period. This method is predicated on historic knowledge and developments, assuming that a constant proportion of sales will turn out to be uncollectible over time.