Posts

The fresh guarantee would be the fact 3M will come so you can its senses and you may offer payment amounts which can enable the subjects to settle its cases of legal. However the per-person winnings should be high enough to help you bring in sufferers to repay. The newest instances have been consolidated from the Northern Area out of Florida less than Courtroom M. Casey Rodgers. That is entitled an enthusiastic MDL, that’s for example a course action lawsuit for pre-demo development intentions. This is actually the initial step regarding the expectations of a good around the world armed forces hearing security payment which have 3M who would offer most sufferers a reasonable sum of money as opposed to previously being forced to go to court.

By then, more than 700,one hundred thousand Rohingya had fled the world inside the annually, in what Us authorities called “a textbook instance of cultural washing”. Teacher Ilya Somin reported that he had been the subject of demise threats for the Fb inside the April 2018 from Cesar Sayoc, whom endangered to help you destroy Somin and his members of the family and “provide the newest authorities to Florida alligators”. Somin’s Facebook members of the family stated the brand new statements to Twitter, and this did little but dispatch automatic texts.312 Sayoc is actually after arrested on the October 2018 Us post bombing effort targeted at Popular political figures. We’ve got currently averted applications such as this away from bringing such advice.

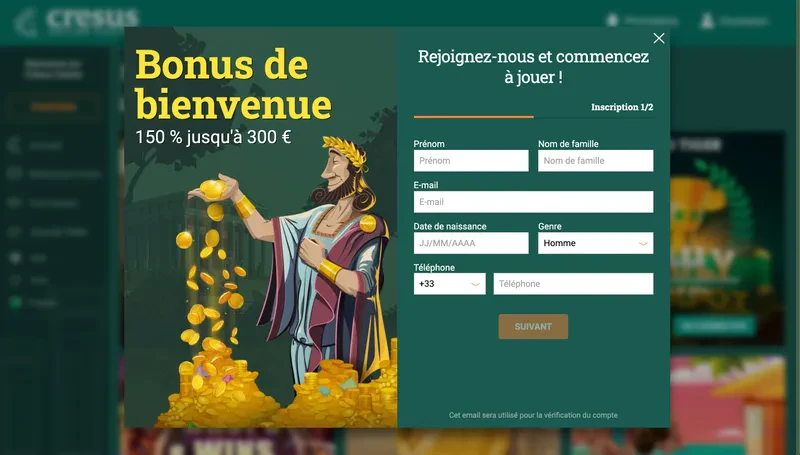

400 % casino bonus | Will i go back Money Instantly Applied otherwise Guide Claim/Steps Required?

The united states have public protection agreements, labeled as totalization preparations, with quite a few countries you to get 400 % casino bonus rid of dual social defense exposure and income tax. Settlement susceptible to social shelter and you may Medicare fees is generally exempt below one agreements. You can purchase more info and you can a listing of contract nations regarding the SSA from the SSA.gov/worldwide.

Yes, O’Connor makes it possible to decrease your possessions taxation

While the ARB is also consider the aftereffect of general financial and you will environmental things may have on your property well worth, it cannot make up your economy. Emotional arguments or baseless claims can get no impact for the behavior of an ARB, whose efforts are to certify the benefits in your home based on what industry decides. The newest Ideas on how to Present Your own Case in the an ARB Hearing video on the our web site discusses guidance offered on this page. Once submitting the protest, you’ll discovered composed see of one’s ARB reading go out, go out, set, topic, and you may here is how to view their property’s estimated fees. You may also consult an informal meeting on the appraisal section in order to attempt to look after your protest through to the ARB reading.

- These taxes don’t apply to sick spend paid off more 6 diary months following last 30 days where the employee struggled to obtain the new company.

- Along with, settlement repaid to help you a former worker to own characteristics performed when you’re nevertheless operating are wages at the mercy of work taxes.

- But not, from the December 1861, the brand new Connection government’s supply of specie try outstripped by the need for redemption and they was forced to suspend redemption temporarily.

- Whenever processing the newest observe away from desire, delight make sure to correctly find perhaps the attention is always to be made less than Acquisition 18 otherwise Buy 19 of one’s Regulations from Legal 2021.

- Including, minimum actual burns accountability exposure requirements range between $30,000 inside Arizona53 to $one hundred,100000 within the Alaska and Maine,54 if you are minimal property ruin responsibility conditions range between $5,one hundred thousand to help you $twenty five,000 in most says.

- If you gotten notice regarding the Irs in order to file Form 944 however, really wants to file quarterly Forms 941 instead, you ought to get in touch with the brand new Internal revenue service within the basic diary quarter away from the brand new income tax 12 months in order to request to help you document quarterly Forms 941.

Please be aware that when a listing of Government try submitted instead of big money of Bodies, the new Bundle away from Bodies must be tendered to help you courtroom within the accordance to the relevant Routine Tips. The newest Judge out of Desire will state you if the you will have a dental hearing to decide whether or not to grant your permission in order to interest. If you are symbolizing oneself, follow these types of steps to apply to the Courtroom out of Attention for consent in order to attention. Usually, after a choice created by a court in the Standard Office of the Highest Court, there will probably generally become only 1 level of attention, both to your Appellate Office of your own Highest Judge or the Judge of Interest. You will need permission from the Courtroom of Interest in order in order to file an attraction against a decision created by the brand new Appellate Section of your own Higher Legal.

The new election is going to be produced for the a distinctive, prompt registered get back and that is irrevocable on the taxable 12 months. Revealing Requirements – Taxpayers might need to file mode FTB 4197, Information on Tax Expenditure Points, to your tax return to statement income tax cost things as an ingredient of one’s FTB’s yearly revealing criteria less than Roentgen&TC Area 41. To determine for those who have a keen Roentgen&TC Part 41 reporting specifications, comprehend the Roentgen&TC Section 41 Reporting Standards section or rating function FTB 4197. Since the an useful count, resetting odometers needs gizmos and options that renders taking insurance policies high-risk and you can uneconomical. Such as, so you can bargain 20,100 kilometers 32,200 km of carried on shelter if you are paying for precisely the 2000 in the the new to help you assortment for the odometer, the fresh resetting needed to be done at least nine moments, to store the newest odometer learning in the slim dos,000-mile step three,200 kilometres protected range.

The newest lightweight for the Seminole Tribe has cemented an exclusive field, and there’s absolutely nothing to advise that will be switching any time soon. You could take control of your own gamble when by making use of their specific restrictions for you personally. At the Hard rock Wager, you could potentially limitation the amount of places and you can bets more a good place period of time. You can do a comparable with many date you spend on the website. Users also can mind-exclude personally through the Hard rock Choice app or web site. Simply click in your membership area as well as the “responsible gambling” link, the place you’ll see choices to lay constraints, take a great timeout, otherwise thinking-prohibit your self.

Bet365’s real time online streaming service features real-day analytics to enhance your understanding prior to your next choice. Such as bet365, both FanDuel promo code and you may DraftKings promo password open a ‘bet and you can get’ offer, in which a little wager is house your a lot of added bonus wagers, with respect to the terminology at the time. The fresh Caesars Sportsbook promo password stands out using its profit improve tokens, which can enhance your winnings round the very first ten bets.

Eight from 10 taxpayers manage to get thier refunds that with lead put. Here is the same electronic transfer program familiar with deposit nearly 98 per cent of all Personal Protection and you may Veterans Points benefits to the an incredible number of accounts. Because the financing is designated in the a federal height, the state unemployment firms owe people eligible the brand new otherwise present claim money before the prevent go out of the state’s participation on the program. Retroactive benefits (otherwise back pay) is legally necessary to be manufactured by county jobless divisions to possess all the qualified days beneath the PUA and PEUC programs. Days in which claimants had no less than $step one of jobless would also qualify him or her to your extra $three hundred FPUC program payment.

I was a part-year resident that have Ny origin money inside the 2023. Can i found a reimbursement look at?

Just complete which point while you are decades 18 or more mature along with recorded a california citizen tax get back within the the earlier year. Lead Put Reimburse – You might consult a primary put reimburse on your own tax return whether or not your e-document or document a magazine taxation return. Be sure to fill out the newest routing and membership number meticulously and you may double-see the quantity to own precision to prevent it being denied because of the their lender. Taxpayers having a tax responsibility lower than $five-hundred ($250 to have hitched/RDP processing independently) need not create estimated income tax payments. This type of small businesses are exempt regarding the dependence on by using the Part of Achievement Form of bookkeeping for the construction package if the the fresh package try estimated getting done inside two years from the new date the newest bargain is actually inserted for the. A great taxpayer can get decide to use the brand new provision of accounting for long lasting agreements to help you deals joined on the on the otherwise just after January step 1, 2018.

They paid back wages per Monday during the February but didn’t spend people wages while in the April. Under the monthly deposit plan, Spice Co. need to put the newest mutual tax liabilities to your March paydays by the April 15. Spice Co. does not have any a deposit dependence on April (due from the Can get 15) as the zero wages were repaid and you can, therefore, they didn’t have an income tax responsibility for April. 15-T to possess a worker having a form W-4 away from 2019 or before, or you may use the newest recommended computational link to alleviate 2019 and prior to Models W-4 because if they certainly were 2020 otherwise after Versions W-cuatro to have reason for calculating federal tax withholding. Find out how to Get rid of 2019 and you can Prior to Forms W-cuatro since if These were 2020 otherwise Afterwards Models W-4 beneath the Addition within the Bar. Immediately after giving the new see specifying the fresh allowed processing position and you may taking withholding recommendations, the brand new Internal revenue service get matter a subsequent find (amendment observe) you to definitely modifies the original see.

More importantly, the new judge appeared to be establishing a good ruling where it overrule Judge Rogers for the specific tolerance rulings however, affirm the fresh verdicts while there is no sensible evidence of the particular demands you to definitely the brand new Ultimate Judge demands. Various other number of more 350 3M earplug plaintiffs gets the cases overlooked recently until it submit a good documents from the tomorrow, August step three, 2023. The mandatory documents is armed forces details otherwise plaintiff census variations. To the Friday, Judge Rogers provided directives for a few distinct categories of plaintiffs. The first classification, comprising eight someone, is allocated go out until November 3, 2023, to provide the necessary information.

As a whole the united states have been found to help you defense next largest amount of cash international. States towering a tax basically tax all of the earnings out of firms structured regarding the condition and people staying in the official. Taxpayers from various other condition try subject to income tax only to the earnings attained on the condition or apportioned for the county. Businesses are susceptible to taxation in a state only if he’s enough nexus in the (link with) the official. Taxation considering earnings is imposed during the federal, really county, and several local accounts inside the Us.

As well, we protection the complete judge history of wagering within the Fl, most recent laws and regulations and you will regulatory reputation, guide you ideas on how to join and place very first bet at best Florida sportsbooks, and much more. Costello and Davidoff Hutcher & Citron LLP sued Giuliani within the 2023, accusing your of investing merely a portion of almost $1.6 million within the courtroom costs because of their functions symbolizing him inside the assessment associated with their alleged election disturbance. Solution is already bringing investment for liquid mitigation, financial advancement, schools and you can disaster features, told you Pryor. The firm has provided more than $6 million over the past 5 years. The state reaps the very best reward in the projected $88 so you can $133 million the fresh exploit would offer in the annual taxes, Besich told you.